President Trump has proposed a significant shift in the nation's tax policy that will profoundly impact the economy and the lives of many Americans. He has pledged to eliminate the tax on tips and Social Security for seniors, a move that would directly increase the disposable income of millions of individuals. This policy aims to reduce the financial burden on workers in the service industry, who often rely on tips as a substantial part of their income. Additionally, by removing the tax on Social Security, seniors would retain more of their retirement benefits, providing them with greater financial security and boosting their ability to contribute to the economy through increased spending. These changes would inject a substantial amount of money back into the economy, fostering growth and benefiting various sectors, particularly those dependent on consumer spending.

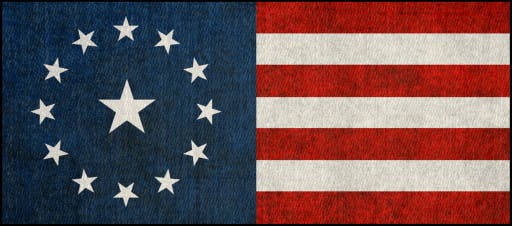

Furthermore, President Trump has hinted at a broader and more transformative tax reform by suggesting the removal of the income tax altogether, replacing it with the Tariff Act of 1930. This act, originally designed to protect American industries by imposing duties on imported goods, could serve as a new revenue stream for the federal government. Shifting to a tariff-based tax system would not only replace the revenue lost from income taxes but also encourage consumers and businesses to prioritize American-made products. This approach could lead to a revitalization of domestic manufacturing, job creation, and a reduction in the trade deficit. By focusing on tariffs, the government would shift the tax burden from individuals to imported goods, potentially making American products more competitive both domestically and internationally.

President Trump's vision also includes a drastic reduction in the size and spending of the federal government. He believes that the current federal government is excessively bloated and can be trimmed down to a fraction of its current size. This reduction in government size would entail significant cuts in federal spending, which he argues is currently out of control. By minimizing government expenditure, the aim is to reduce waste, increase efficiency, and return more financial resources to the public. This approach, combined with the proposed tax reforms, is designed to decentralize financial power, diminishing the concentration of wealth among the elite and redistributing it across the broader economy. The overall goal is to create a leaner, more efficient government that spends less, taxes less, and stimulates economic growth through increased consumer spending and industrial production within the United States.